It was the best of times, it was not the worst, but some pretty bad times. In the tale of two stock markets facing U.S. investors, the S&P 500 is soaring to new records driven by a single company, Nvidia NVDA -3.54%, while less-important companies fall and remain far below their highs.

The Russell 2000 index of smaller companies is down 17% from its November 2021 peak and has made no progress at all this year.

In the S&P 500, which includes the biggest companies, the average stock is about where it was at the start of 2022, and more than half of the current constituents are down since then. Worse still, only 198 have managed gains this month, even as the index reached new intraday highs on 11 out of 13 trading days.

This narrowing of the market is prompting concern among technical analysts, who think broad gains by lots of stocks—so-called breadth—make a bull market more sustainable.

In fact, what it indicates is that there are two different things pushing stocks around: demand for chips to drive artificial intelligence, and concern about the economy and interest rates.

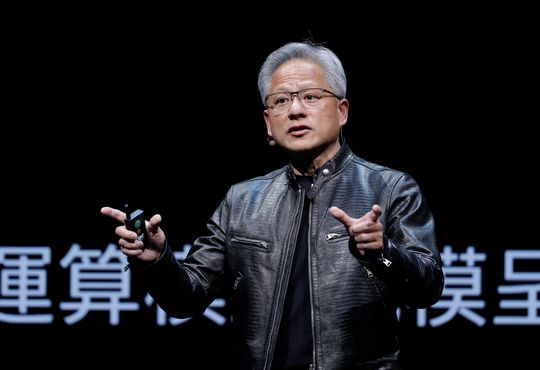

The first has led Nvidia, a handful of other stocks and the market as a whole to new highs, and made Nvidia the world’s most-valuable company. The second has pushed most stocks down, as weak data lowers expectations for growth while the Fed continues to worry about inflation.

I agree that in this case the lack of broad gains puts the rally at risk, but for a different reason than some might think.

My worry is that the market is overly reliant on just one stock, Nvidia, which on its own accounted for a third of this month’s gain in the S&P 500 before Thursday’s pullback and 44% of the gains since the start of 2022. If Nvidia stops performing—because demand for chips weakens, because AI hype runs into reality or simply because everyone already owns it—the index would be reliant on the rest of the market. And the rest of the market is much less solid.

Investors buy the S&P through cheap and popular index ETFs because they want to spread their exposure across lots of companies. At the moment they are buying a lot of Nvidia-specific and broader AI risk. That has worked out so far, as the AI race led to extraordinary demand for Nvidia chips, but the S&P is doing a lot less to diversify risks than it used to.

It is possible that the rest of the market could step up if Nvidia stalls. But other stocks boosted by AI hopes are unlikely to do well if Nvidia does poorly, so gains would rely on the economically sensitive stocks outside Big Tech. And Nvidia’s now so big that falls in its shares can drag down a market that otherwise would have been fine, as on Thursday, when the S&P would have been up if it weren’t for the chip maker’s drop.

The trouble here is that investors are growing concerned about growth, while worrying that the Fed won’t cut quickly enough to help out. Bond yields have been coming down, with the rate-sensitive two-year yield down from above 4.7% at the end of April to 4.26%. But traders have all but given up on rate cuts coming both next month and in September, as Fed officials caution that they need more evidence that inflation’s heading toward their target.

That has led to a switch in behavior by smaller stocks in the S&P this month. Instead of being buoyed by lower bond yields, the average stock fell as bond yields fell. Even the tiddlers of the Russell 2000, which tend to have more debt and thus tend to be more sensitive to yields, didn’t benefit. A weaker economy without much in the way of rate cuts isn’t a nice prospect for investors at a time when high rates are already hurting low-income consumers and smaller and weaker companies.

The good news is that the market is fickle. It could easily switch from worrying about a weak economy back to thinking growth is strong, particularly since the latest data has been mixed. The Atlanta Fed’s GDPNow estimate for growth in the second quarter, based on data out so far, is back above 3% annualized, a very good figure.

Luckily for those who passively bought the S&P 500, all concern about the economy has been drowned out by the huge gains for Nvidia, Apple and Microsoft—which have added more value this month than all other members of the S&P put together.

Can that really continue? Charles Dickens wrote that “it was the epoch of belief, it was the epoch of incredulity.” I lean toward the latter.