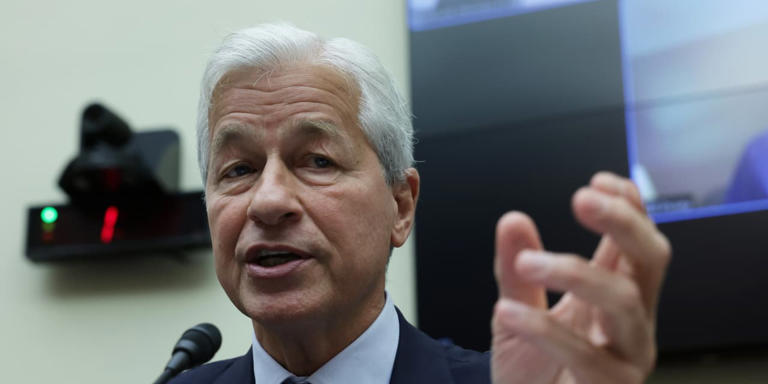

JPMorgan Chase & Co. Chief Executive Jamie Dimon said the market plunge and partial recovery in the past week amounted to an ”overreaction” by investors. He added that ”America is alive and well.”

The longtime chief executive of JPMorgan Chase said that despite the turmoil and some negative data points of late, his outlook for a potential recession remains roughly the same as it was about six months ago, at a 35% to 40% chance of a hard landing for the U.S. economy.

“Markets fluctuate,” he said in an interview with CNBC Wednesday.

Dimon said he remains “skeptical” that inflation will come down enough to meet the U.S. Federal Reserve’s long-run target of 2%.

“You have to be prepared for all outcomes … and invest consistently,” he said.

Dimon said he met recently with billionaire Warren Buffett of Berkshire Hathaway Inc. and the two spoke about the “resiliency of America.”

While credit trends at JPMorgan Chase are returning to historically normal patterns, “it doesn’t mean they can’t get worse,” Dimon said.

One key indicator for the country’s economic health are the job numbers, he said, adding that as long as employment levels remain healthy, banks will continue to have strong balance sheets.

Asked whether he’d consider working in the public sector, possibly as Treasury secretary, Dimon said he’s happy where he is.

He said the op-ed column he wrote for the the Washington Post last week about leaders who welcome opposing views remains relevant. He declined to endorse a candidate for U.S. president.

Dimon reiterated comments that he plans to retire in less than five years from his current job but said he could remain at the bank for years as chair, if the bank’s board wants him.

The interview came as the high-profile bank executive was on his 14th annual bus tour, which is focused this year on the Midwest.