A gradual cooling of the still-solid labor market extended into November, renewing optimism the economy is still on a glide path for a soft landing.

Employers added a seasonally adjusted 199,000 jobs last month, the Labor Department reported Friday, slower than earlier in the year but consistent with gains before the pandemic. When excluding the effects of auto-worker strikes in recent months, November’s job gain was roughly 169,000, slightly cooler than 180,000 in October. Most recent hiring occurred in two big sectors: healthcare and the government.

Friday’s report “was almost perfect,” said Samuel Rines, managing director for Corbu, a market advisory firm in Houston. “And there are reasons to believe job growth can continue into 2024.”

Following the jobs report, all three major stock indexes closed at their highest level of the year on Friday. The Dow Jones Industrial Average was up 130.49 points, or 0.36%. The 10-year Treasury yield rose 0.115 percentage point to 4.244%. Bond yields rise as prices fall.

Other data in the report showed the labor market remains strong. The unemployment rate fell to 3.7%. It had climbed to 3.9% in October from 3.4% in April, fanning fears on Wall Street of a more rapid slowdown ahead. Often, a rise in the unemployment rate of that magnitude has coincided with the start of a recession.

A half-million more Americans entered the labor force in November and many who were looking found jobs, according to a survey of households. On a monthly basis, wage growth picked up in November. Average hourly earnings advanced 4% from a year earlier, a good raise for workers but a figure consistent with a continuing slowdown in inflation.

Tempered Enthusiasm for Cuts

The jobs report keeps the Federal Reserve on pace to hold rates steady at next week’s meeting and challenges the view that the central bank will quickly shift toward cutting rates next year. Low unemployment, moderating job gains and easing inflation are consistent with a so-called soft landing, where inflation cools without a recession.

The data likely reinforces Fed Chair Jerome Powell’s latest guidance that the central bank can hold its policy rate steady for now as it judges how an aggressive series of rate increases over the past two years will slow economic activity and inflation in the months ahead.

Friday’s report could temper enthusiasm by bond market investors that the central bank will cut interest rates as soon as March. For that to happen, the economy would likely need to show signs that hiring, spending and investment are slowing sharply, something that isn’t evident in recent economic data.

On Dec. 1, Powell offered the strongest signal yet that officials are likely done raising rates, but his comments were laced with caution. He said it was too soon to confidently conclude that the Fed was done increasing rates or to speculate about rate cuts.

Finding Better Balance

Kelsey Collins recently landed a new job as an assistant store manager for a small boutique that sells jewelry, home décor and gifts. Collins started the position in the Indianapolis area last month, and said she took a step down in pay and title compared with her previous job at an eyewear retailer.

“This business seems to really understand work-life balance,” Collins said of her new employer. “So I’m looking forward to having more evenings and weekends available to spend with my friends and family.”

Collins, 33 years old, said she last looked for a job in late 2020, and her search this time was a bit harder, including because she got pay offers that were too low. “I would get an interview and talk to someone and then after hearing about the company, it wouldn’t be a good fit,” she said.

Recent labor market trends indicate “progress toward the soft landing,” said Stephen Juneau, U.S. economist at Bank of America. “But also things are pointing toward a labor market that’s getting into better and better balance over time,” meaning the number of available workers is growing while employers’ hiring needs are easing, lessening labor shortages and wage pressures.

A robust pace of job gains and wage growth earlier in the year helped propel consumer spending, prompting strong economic growth over the summer. Labor shortages gave workers strong leverage and prompted employers to raise wages and perks to try to fill a high number of job vacancies.

More recently, job openings are falling, and workers are quitting their jobs less. Hourly wage growth, while still outpacing inflation, has cooled from early in the year, when it rose as much as 4.7% annually.

Walmart, the nation’s largest private employer, has cut starting pay for some new hires. The music-streaming company Spotify said earlier this week that it is preparing to lay off 17% of its workforce.

Many economists expect cooler wage gains, along with other softening labor market conditions, to weigh on consumers and economic output in 2024. They have reduced their forecasts for a recession, however. Economists surveyed by The Wall Street Journal in October saw a 48% probability of a recession within the next year, the first time they put the number below 50% since mid-2022.

Mike Cocozza, owner of luxury home-building company Trinity Construction and Design in Sarasota, Fla., noticed more subcontractors contacting him looking for potential work in the past three to four months. He thinks that is because hiring at home builders is easing, given higher mortgage rates.

Higher interest rates are “going to free up labor across the board and help kind of satisfy some of the demand that we’ve been seeing here,” he said, noting the company has needed skilled workers, such as carpenters.

Industry standouts

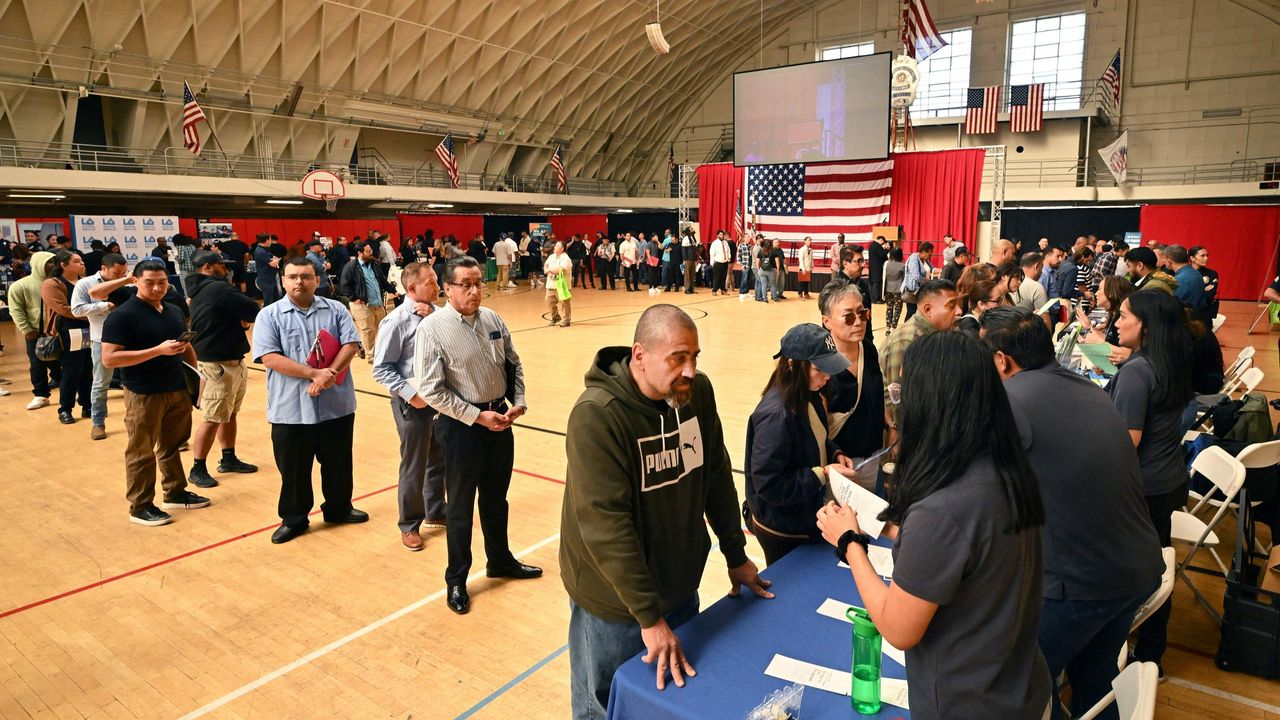

Americans who are still looking for jobs now might find them in healthcare or government.

Those sectors have seen a strong pace of hiring recently, accounting for nearly two-thirds of job gains in November. Healthcare, in particular, could continue to be a bright spot for years to come because of an aging U.S. population and the lingering effects of the Covid-19 pandemic.

Hiring in the transportation and warehousing industry was essentially flat last month, while retailers shed jobs. Some businesses have reported needing fewer workers for holiday jobs this year.

Leisure and hospitality employers added roughly 40,000 jobs in November, mainly driven by restaurants and bars, according to the Labor Department. Employment in that industry, which was hard hit by the pandemic, is close to returning to its level in February 2020.