2023 has proven to be a formidable period for the US venture ecosystem.

Dealmaking and valuation metrics have either plateaued or declined across nearly all stages, while the current investing climate remains the most investor-friendly it’s been in nearly a decade.

The IPO landscape remains relatively frozen, with just 27 public exits totaling $22 billion in Q3. While some encouraging IPOs occurred, caution is still warranted, as exemplified by Instacart and Klaviyo going public at reduced valuations.

Median public listing valuations have hit a 10-year low, further signaling diminished investor enthusiasm. On the other hand, M&A deals witnessed an increase in median valuation, indicating acquirers’ continued preference for well-established, high-performing companies.

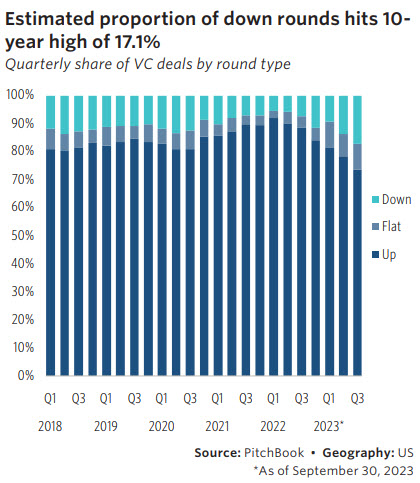

Despite the hope of many startups that their existing financial runway will weather these challenging conditions, a significant proportion have been able to evade the market. 17% of all deals in Q3 were down rounds, the highest percentage in a decade.

Additionally, the erosion of value creation between rounds continues to pose a significant challenge for startups and their investors, which not only limits return potential but also complicates the fundraising process for fund managers.

As we’ve long discussed, the ongoing turbulence within the venture landscape is particularly concerning for nontraditional investors, who were the first to retreat from venture capital as the economic landscape shifted last year.

Many of these investors have remained on the sidelines, scaling down their involvement in the venture ecosystem. The absence of these investors raises concerns, given the substantial capital they injected into the VC ecosystem in recent years.

As the year progresses, Q4 is poised to present challenges for founders, investors, and other VC participants. The question remains whether the worst is behind us or if there are further challenges ahead.

Until a clearer picture emerges, get more data and analysis in our new US VC Valuations Report.