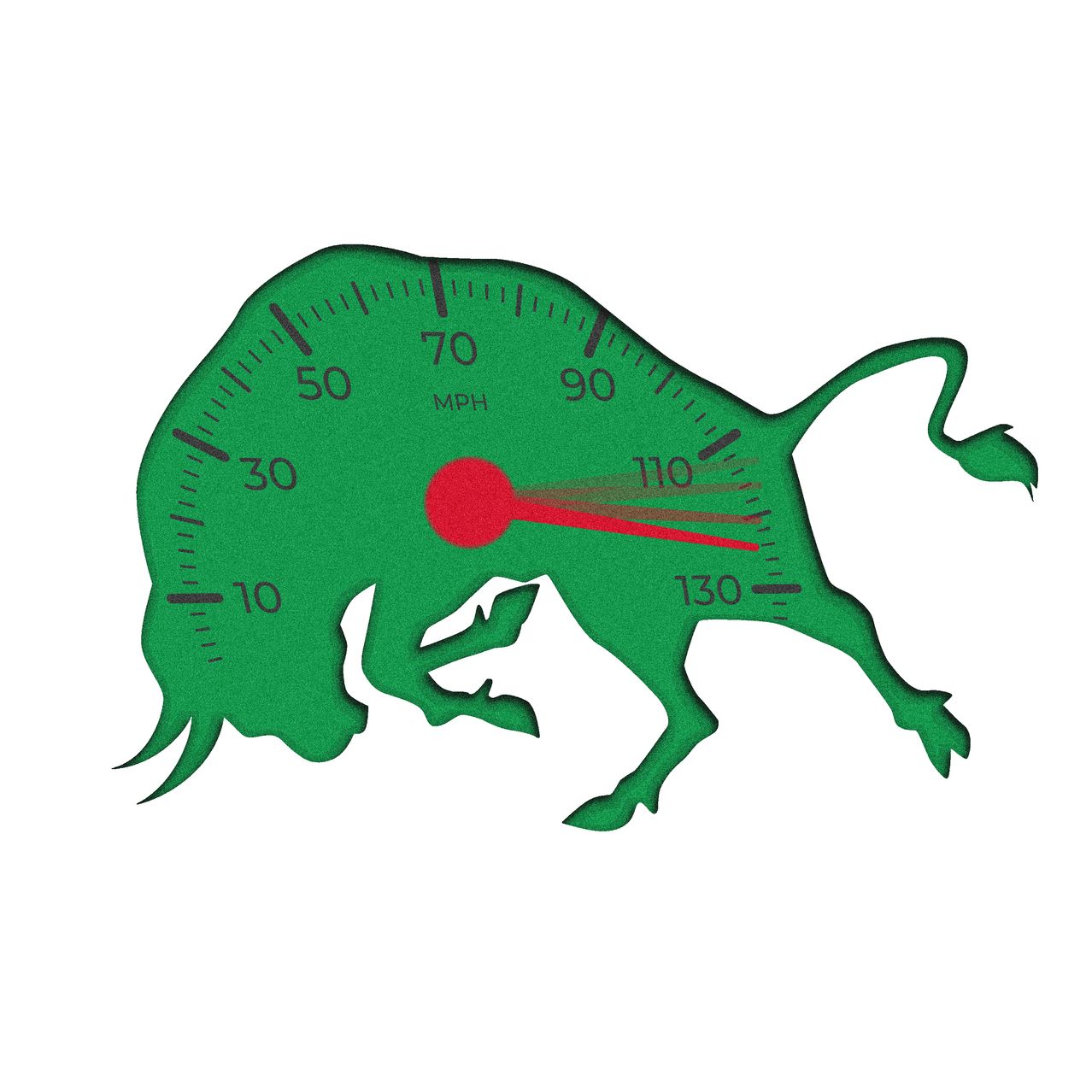

FOMO in the stock market is back.

A lightning-fast rebound has driven the S&P 500 up in nine of the past 10 sessions and 7.2% over the past two weeks, the best such stretch of the year. Now, many investors are betting the rally has legs.

Some have piled into funds tracking U.S. stocks, while others have abandoned trades that would profit in times of market turmoil. Many have slashed bearish wagers against the S&P 500 and tech-heavy Nasdaq-100 index, fearful of getting caught flat-footed if the big gains continue.

The Cboe Volatility Index, or VIX, known as Wall Street’s “fear gauge,” has plunged from its October highs, and recently slid for eight consecutive sessions. It is a sign that traders are abandoning insurance-like contracts that would protect them from a stock swoon in coming weeks, or expecting markets to stay placid.

“People are trying to position for a year-end rally at this point,” said Zhiwei Ren, a portfolio manager at Penn Mutual Asset Management.

Ren said he took a cautious stance in markets for much of this year, concerned that a recession was right around the corner. The market advance has pushed him to rethink his approach. Recently, he scooped up some bullish bets tied to the S&P 500 in the options market to profit from any bigger gains that might come through the end of the year. Activity in such options hit one of the highest levels on record in November.

Behind the market’s U-turn? Stocks and bonds got a double boost from Washington earlier this month. The Treasury increased the size of longer-term debt auctions by a smaller amount than many had expected, and the Federal Reserve hinted that it likely won’t raise interest rates again this year.

Government bond yields, which have stirred much of the recent volatility, dropped after breaching 5% for the first time in 16 years in October, giving ammunition to the stock bulls. The S&P 500 is sitting on gains of 15% for 2023, while the Nasdaq Composite is up 32% after notching its best day since May on Friday.

In the coming days, investors will parse the latest round of inflation data when the consumer-price index and producer-price index figures are released on Tuesday and Wednesday.

With just a few weeks left of 2023, the doomsday forecasts on the economy that Wall Street entered the year with don’t seem to be panning out.

Charles Shriver, a portfolio manager at T. Rowe Price who oversees about $50 billion in assets, said he kept a sizable chunk of his portfolios in cash for much of the year and took advantage of the October market swoon to pour some of it into equities. He says he expects stocks to keep rising.

“We would look for opportunities to add to equities,” Shriver said.

U.S. stock exchange-traded and mutual funds drew around $4.2 billion in the week ending Nov. 8, one of the biggest hauls this fall that capped a three-week stretch of inflows, according to LSEG Lipper Global Fund Flows.

Meanwhile, bearish bets by hedge funds and other money managers against the S&P 500 recently fell to the lowest level since June 2022, according to data from the Commodity Futures Trading Commission. Bets against Nasdaq have slumped to the lowest level since March.

And individuals say they are growing more bullish about stocks. The share of investors who said they expected share prices to rise over the next six months jumped to 43% last week, a sharp rise from 24% a week prior, according to a survey by the American Association of Individual Investors. The share that said they were bearish nearly halved to 27%.

Jan Hatzius, a Goldman Sachs Group economist who has been among the most optimistic on Wall Street about the U.S. economy, said in a recent note to clients that it has performed even better than he expected. He expects inflation to keep falling over the next year.

As yields have decreased, investors are also abandoning trades that would profit if the stock market’s stars stumbled. Bets that would pay out if the Magnificent Seven—Apple, Microsoft, Alphabet, Amazon.com, Nvidia, Tesla and Meta Platforms—tumbled are hovering near an all-time low, according to Bank of America data.

The stocks have played an outsize role in this year’s rally, responsible for most of the S&P 500’s advance.

“If we are at the peak [in rates], then there is good times ahead” for stocks, said Dev Kantesaria, founder of Valley Forge Capital Management, which oversees around $3 billion in assets.

Kantesaria said he’s holding almost no cash in his portfolio and is all-in on stocks. He says his bullish view, in the face of dour warnings from many economists and analysts about the economy and markets, has paid off.

“I think to be a great equity investor, you have to be an optimist,” Kantesaria said.