CFOs are widely focused on reducing costs, spotting M&A opportunities, and restructuring supply chains, per Grant Thornton.

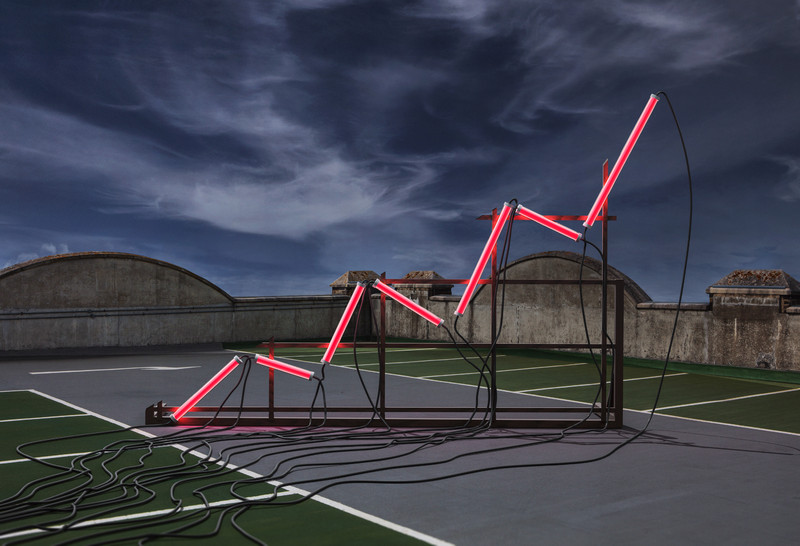

The overall economy — and the issues it creates — are arguably the largest challenge for CFOs this year. Yet confidence to achieve growth is prevalent among financial executives, according to recent survey data from Grant Thornton. A majority of CFOs (64%) of the 246 surveyed said they predict net profit growth in 2023, with 42% going as far as to predict a growth of 6% or higher.

Reducing Costs

Despite confidence in their own growth efforts, the overall economic risks linger. “The companies that I’m talking to are all focused on cost reductions,” said Sean Denham, Grant Thornton’s national audit growth leader. “Usually when people are focused on cost reductions, it’s because they don’t have a positive outlook on the future.”

More than half (58%) of CFOs surveyed chose cost optimization among their top three areas of concern for the first half of 2023, while another 40% chose workforce rationalization among their top three. With labor being a major component of cost for CFOs, more than half (58%) told surveyors they expect continued challenges in attracting and retaining the right talent.

Over a third of CFOs chose more traditional aspects as top concerns, with both liquidity and capital expenditure management and cybersecurity to round out their top three (37% and 34%, respectively). According to surveyors, cost reduction can be met without having to turn to layoffs. Tools such as external consulting, tech investments, and reduced travel expenses are all on the table for CFOs looking to trim allocations without impacting their headcounts.

Stagnant Supply Chain Problems

According to Denham, external economic factors still have a lasting impact. “When the cost of capital was close to zero, companies could put all the inventory they [wanted] in their warehouses,” he said. “Now that interest rates are going up, they have to decide whether to increase inventory because of potential supply chain issues. The cost of that is going to be a factor.”

Grant Thornton’s results found that 41% of respondents rated supply chain issues as a top challenge in Q3 of last year.

External factors having an impact on the looming supply chain problem are a recurring pain point for financial executives across the board. In a recent survey by Gartner, focusing on top CFO priorities, surveyors also identified these same uncertainties and different strategies to overcome them.

“There is a lot of uncertainty in the macroeconomic environment, with many CFOs expecting a recession in 2023,” said Marko Horvat, vice president of research in the Gartner Finance practice.

“Many CFOs are also dealing with simultaneous challenges they haven’t faced before, such as heightened geopolitical and regulatory tensions, supply chain shocks, higher inflation, and labor problems,” Horvat said.

Continuing Rise of M&A

As M&A continues to be a highly coveted growth strategy in 2023, research indicates that deal volumes are down. “The sentiment is that M&A volumes are down year-over-year,” said Chris Schenkenberg, national managing partner of Grant Thornton’s regional tax business lines, after surveying “several” private equity professionals on the current M&A market.

According to recent M&A data from Grant Thornton, nearly 72% of M&A professionals expect deals to increase over the next six months. “While rising interest rates certainly affect the cost of capital and investment models, recent decreases in valuations and multiples have a positive effect in some industries,” said Schenkenberg.