The Biden administration officially launched the 2022 student loan debt forgiveness application and millions have already applied for relief.

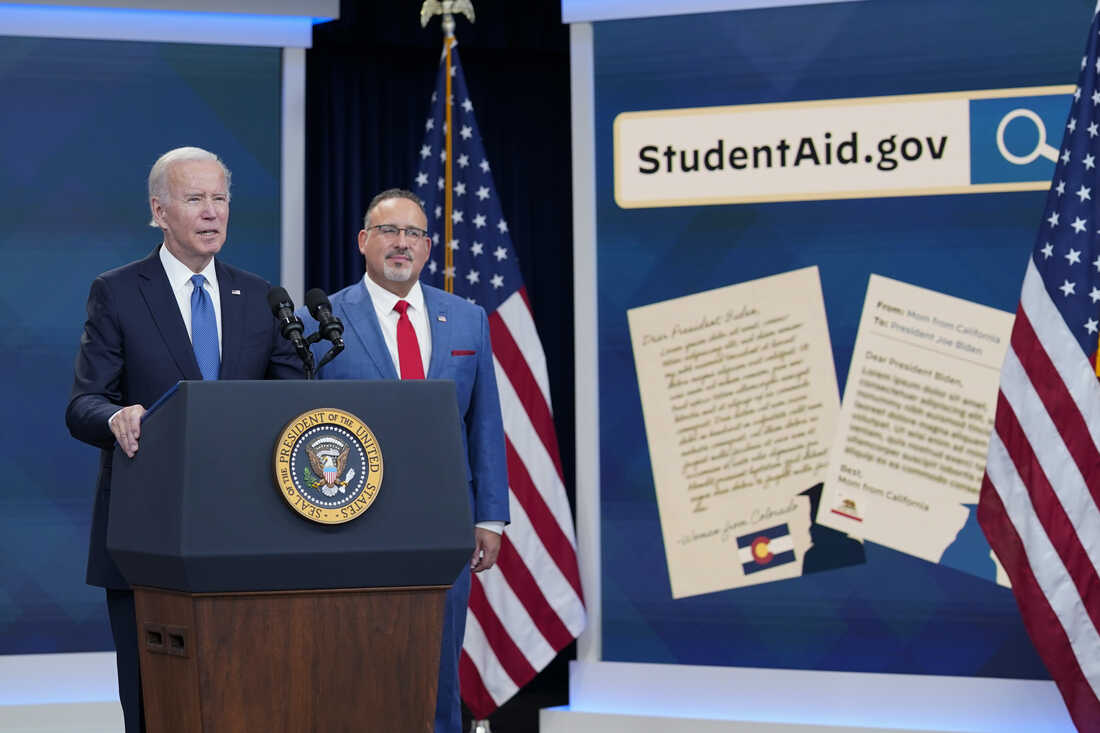

President Biden on Monday announced the official launch of the online student loan debt relief application after millions of borrowers applied for Biden’s student loan forgiveness through a beta version of the site that was released late last week.

During a press conference announcing the launch, Biden called student loan debt forgiveness a “game changer,” saying, “it means more than 8 million Americans are—starting this week—on their way to receiving life-changing relief.”

The application launch comes amidst lawsuits against President Biden’s plan to cancel up to $20,000 in student loan debt for eligible borrowers. Those legal challenges could possibly delay the processing of the student loan debt relief applications—at least until October 23.

Biden’s Student Loan Forgiveness Application: How to Apply

The White House describes the student loan debt relief application as “short and simple,” and says that borrowers will not need to provide any supporting documents or Federal Student Aid (FSA) ID to log in to the system or to apply for student loan forgiveness.

When can you apply for student loan debt relief? The application for student loan debt forgiveness is live now. You may have heard that ahead of the official student loan forgiveness application, the Department of Education was accepting applications through a beta version of the form to help refine the debt relief processes. But President Biden announced the launch of the official live application on October 17 and said that the Department of Education had already received more than eight million applications.

The online application form asks for basic borrower information like name, address, date of birth, and social security number. The student loan debt relief application also asks borrowers to agree to several statements regarding eligibility. For example, borrowers will need to agree to provide proof of income by March 31, 2024, if requested to do so by the Department of Education.

When you’re applying for student loan debt relief, you will also need to affirm that you are the individual applying for the debt relief and that you meet the income thresholds for receiving student loan forgiveness.

Or you can indicate that you were not required to file a tax return in 2020 or 2021. Income limits for student loan debt forgiveness can be based on the adjusted gross income reported on a borrower’s 2020 or 2021 federal tax return.

The Biden administration says that the online student loan debt relief application is available in English, and Spanish, and can be accessed on both mobile and desktop devices. The White House also indicated that a paper form of the student loan debt relief application will be made available.

Do You Qualify for 2022 Student Loan Forgiveness?

Under President Biden’s student loan debt cancellation plan, the Department of Education will provide student loan relief of up to $10,000 to borrowers whose loans are held by the Department of Education, and whose income is less than $125,000 per year.

If you’re married and file jointly, the student loan cancellation income limit is $250,000. (Each spouse will be eligible for up to $10,000 in student loan cancellation). For Pell Grant recipients, student loan relief of up to $20,000 is available.

Do You Have to Pay Taxes on a Forgiven Student Loan?

You may be wondering if you will be taxed on the number of your cancelled student loans. The good news is no, you won’t pay federal income tax on your forgiven student loan debt.

However, some states could or will tax forgiven student loan debt. So far, in what has become an evolving situation, Indiana, Mississippi, and North Carolina have confirmed that they will treat cancelled student loan debt as taxable income.

In any case, stay tuned to any information or guidance coming from your state about cancelled student loan debt.