The pace of blank-check mergers failing to cross the finish line is accelerating as the industry grapples with waning investor interest.

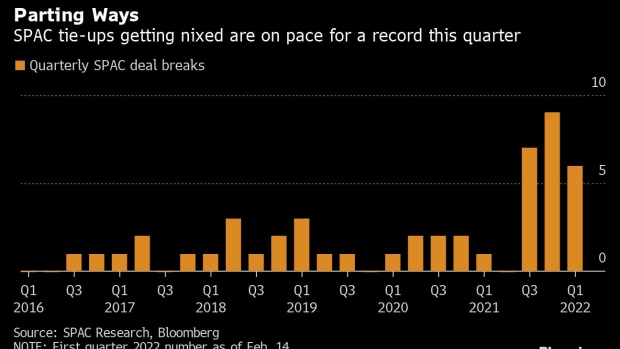

At least six mergers with special-purpose acquisition companies have been canceled this year, on pace for a record number of nixed deals in a single quarter as investors and sponsors navigate a plunge in a conviction for them. At least 22 have been spiked since the middle of last year, according to data compiled by Chicago-based SPAC Research which tracks the industry. That compares with 26 tie-ups that were called off in the more than five years prior, the data show.

Deals between Carlyle-backed Syniverse Technologies LLC and M3-Brigade Acquisition II Corp. and between Acorns Grow Inc. and Pioneer Merger Corp. were among those canceled so far this year. They may signal that the volatility for technology stocks and investors’ desire to return their shares for cash are hitting high-profile mergers.

On Monday, Astrea Acquisition Corp. became the latest company to spike merger plans as its deal to take HotelPlanner and Reservations.com public was scrapped without much detail. The pair struck an agreement to merge in August.

All told, SPACs with more than $2.2 billion in trust have dropped mergers in the first six weeks of the year as they turn their attention to new targets in order to fulfill their mission. That’s on top of the $8.7 billion in trust for blank-checks who saw deals fizzle in the second half of last year, data from SPAC Research show.

Growing jitters over the Federal Reserve’s plans to combat inflation paired with a glut of SPACs hunting for private companies to take public have fueled the uncertainty in the industry. A market for additional financing that aims to help backstop some deals, known as private investment in public equity, or PIPE, has also dried up with a key index tracking SPACs down roughly 41% from last February’s peak.

Redemptions Rising

SPACs are known as blank check firms because they raise money from investors in an initial public offering with the goal of buying a private business that isn’t identified yet. The rise in deals that aren’t crossing the finish line is partly due to investors’ ability to redeem their shares for cash if they don’t like the merger.

The average redemption rate has steadily climbed to the top 90% for deals in February, SPAC Research data show, a stark contrast to less than 10% a year ago.