Two of Wall Street’s largest banks, Goldman Sachs Group Inc. and Citigroup Inc., are recommending bets against a super-sized rate hike from the Federal Reserve in March.

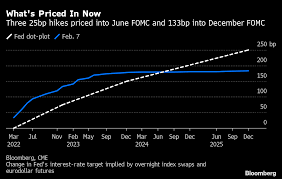

Speculation that the Fed would kick off its hiking cycle with its first half-percentage-point rate increase since 2000 surged on Friday after the Labor Department reported that payrolls expanded at a surprisingly fast pace in January. Swaps markets by late Friday gave roughly 50% odds to such a move, though they have since eased back to around 32%.

Analysts from both Goldman and Citigroup said they see such an aggressive move as unlikely and are suggesting trades that would benefit from a more traditional quarter-point jump.

Goldman strategists including Praveen Korapaty said a way to bet against a 50-basis-point March jump would be to sell December overnight rate index swaps and buy the June version. That trade would benefit from more rate-hike expectations being priced into the December contract, which would likely happen if the Fed opts for a smaller March move.

Citigroup’s base case is also a quarter-point move at the March meeting, “although the pricing for a 50bp move is likely to stay sticky,” strategists Jabaz Mathai and Jason Williams said in a note. They suggest a strategy similar to Goldman’s with eurodollar futures, anticipating that the June 2023 contracts will underperform those due in June 2022 as rate-hike expectations are pushed out.