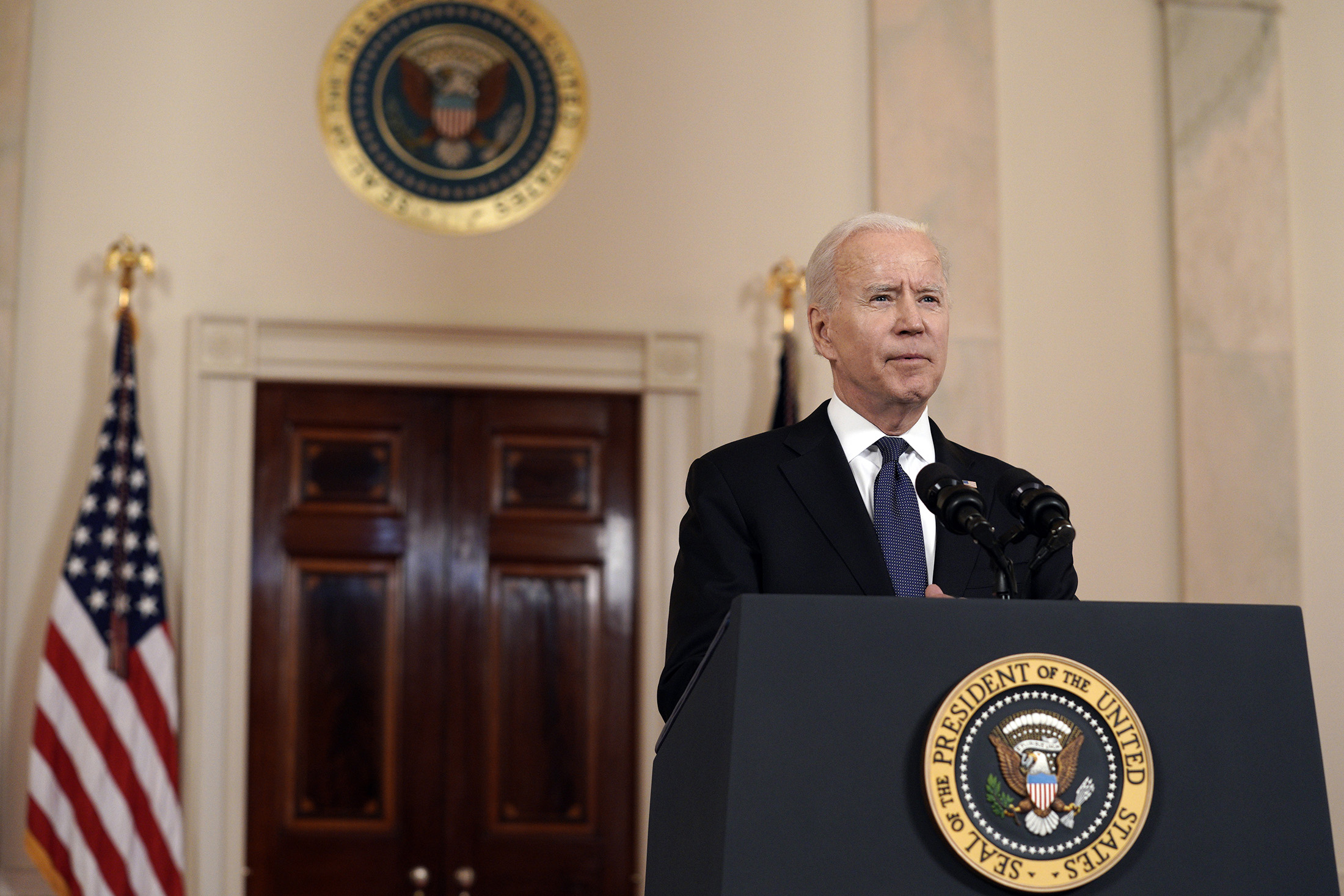

The Treasury Department on Friday released details about President Biden’s tax-related proposals, which would raise a net $2.4 trillion over 10 years.

The release of the “Greenbook” of revenue proposals coincides with the unveiling of Biden’s $6 trillion budget proposal for fiscal 2022.

It fleshes out tax proposals that are part of Biden’s $4 trillion economic plan and includes information both about proposals to raise taxes on the wealthy and corporations, as well as proposals to expand tax credits that would reduce federal revenue.

Biden has split his major economic initiatives into two plans: the American Jobs Plan, which is focused on transportation and addressing climate change, and the American Families Plan, which is focused on areas such as education and child care. The Greenbook focuses specifically on portions of those plans relating to federal revenue and does not include spending proposals unrelated to taxes that are also part of the plans.

The American Jobs Plan includes tax changes for corporations that Treasury estimates would on net raise about $2 trillion over 10 years. It also proposes expanding tax breaks for housing and infrastructure, repealing tax breaks for fossil fuel companies and expanding tax credits for clean energy. Treasury estimated that in total, tax proposals in the plan would raise on net about $1.7 trillion.

The American Families Plan would raise about $700 billion over 10 years through higher taxes on high-income individuals, about $64 billion through ending tax loopholes and about $800 billion through proposals aimed at improving compliance with tax laws, Treasury said. It also proposes extensions of tax credits benefiting low- and middle-income families that would cost about $800 billion over the next decade. On net, the tax-related proposals in the families plan would raise about $700 billion, Treasury said.

One of the ways that the families plan would raise taxes on the wealthy is to tax capital gains at the higher ordinary income rates for taxpayers with income above $1 million. Treasury is proposing for that change to take effect from when it was first announced in April. Officials with the department said they chose this effective date to prevent people from accelerating sales of their investments to utilize a lower tax rate.

The Biden administration has said that the American Jobs Plan and the American Families Plan would be fully paid for over 15 years. Treasury officials said that none of the administration’s proposals raise taxes on those making less than $400,000, in line with Biden’s campaign promise.

This is the first time that Treasury has released a Greenbook along with the release of a budget proposal since the Obama administration.