The growing optimism “is evident in the robust expectations firms have for revenue and employment growth in 2021,” according to The CFO Survey.

CFOs are feeling increasingly optimistic about their firms and the U.S. economy though they don’t expect the Biden administration’s American Rescue Plan to have much effect on their business, according to The CFO Survey.

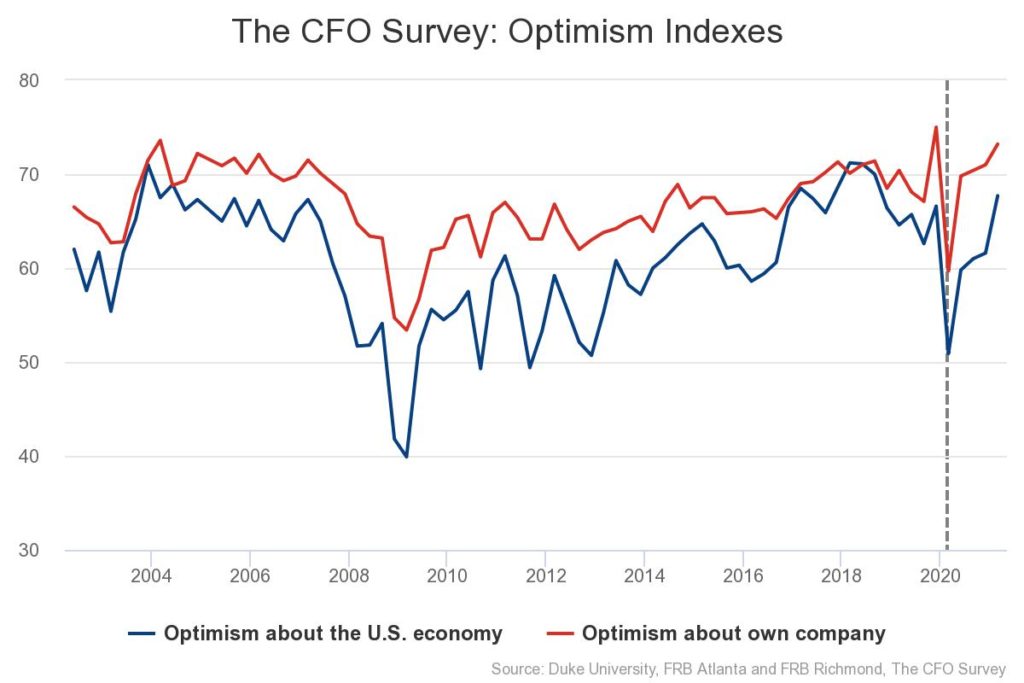

The report, a collaboration of Duke University’s Fuqua School of Business and the Federal Reserve Banks of Richmond and Atlanta (formerly known as the Duke/CFO Global Business Outlook Survey), found CFOs’ average optimism for the financial prospects of their firms was 73.2 on a scale of 0 to 100 in the first quarter.

When respondents were asked to rate their optimism about the overall U.S. economy, the average rating was 67.7.

Both readings were slightly above the fourth quarter’s 72 and 61.6, respectively.

Expectations for revenue and employment growth in 2021 improved from the fourth quarter of 2020. The mean revenue forecast was for an 8.0% increase, up from 6.9% in the fourth quarter, and the mean employment growth forecast was for a 5.5%, gain, up from 4.1%.

“This pick-up in optimism is evident in the robust expectations firms have for revenue and employment growth in 2021,” Brent Meyer, senior advisor and economist at the Federal Reserve Bank of Atlanta, said in a news release.

He also noted that most CFOs anticipate economic growth for reasons separate from the American Rescue Plan.

According to the survey, 76% of firms expected the ARP to have no impact on employment, 65% expected no impact on prices, 55% expected no impact on total wages, and 53% expected no impact on revenue. Nearly 40%, however, expect the legislation to have a positive impact on sales.

“Importantly, these results do not rule out a surge in growth as the [coronavirus] pandemic recedes and the vaccination rollout continues,” Meyer said.

Of the small share of companies that expect increased employment due to the stimulus, a vast majority of them are in service-providing industries and employer fewer than 500 workers, according to survey commentary on the Federal Reserve Bank of Atlanta website.

“The COVID-19 pandemic has hit smaller, service-providing firms particularly hard, so it’s perhaps not surprising to see these types of firms expecting the stimulus to aid in a rebound.”

Those firms also anticipate a boost to pricing from the stimulus, the commentary notes.

“The price growth for services has slowed markedly since the onset of the pandemic. As the economy begins to open up more fully, these firms might believe that measures to bolster household income (among other aspects of ARPA ) will lead to a bit more pricing power.”

The CFO survey also found that only about one-third of firms anticipate investing in structures or land over the next six months. Nearly two-thirds of firms anticipate spending on equipment in the near-term, but among these firms many said they were investing to replace or repair existing equipment, rather than to increase capacity.

The survey was fielded from March 15 to March 26.