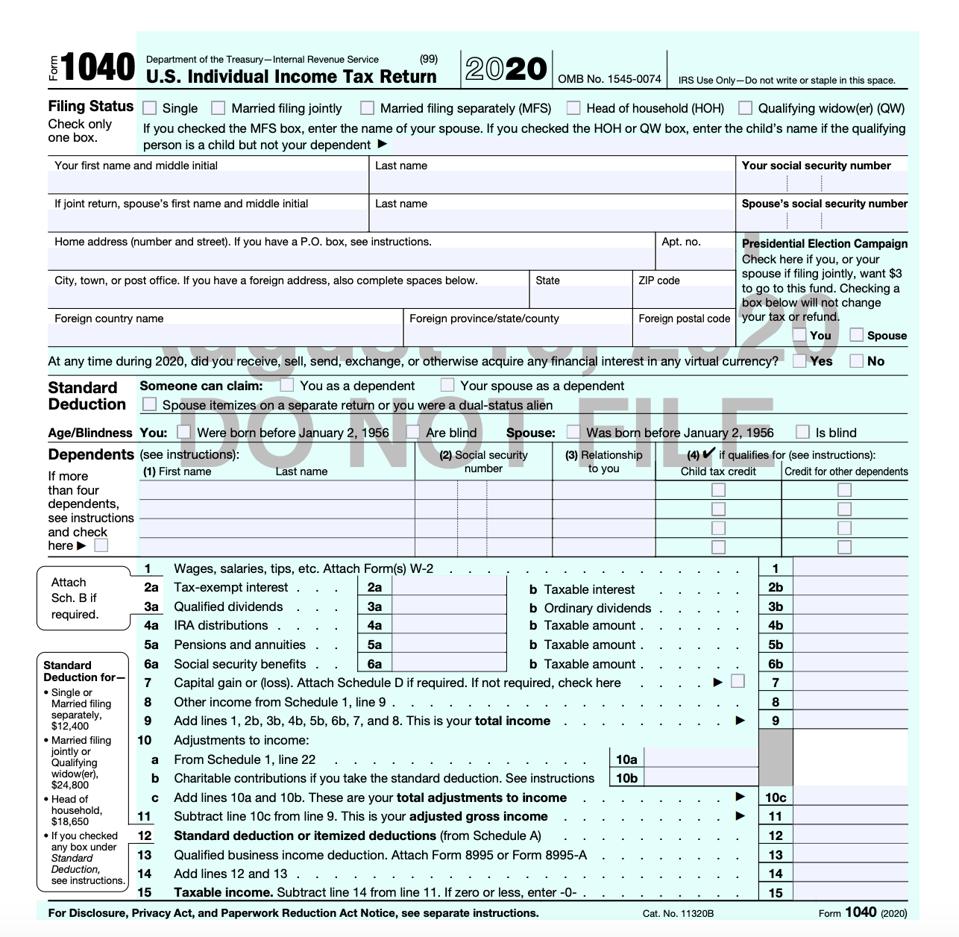

The Internal Revenue Service (IRS) has released a draft of Form 1040, U.S. Individual Income Tax Return. There are several notable changes to the form proposed for the tax year 2020 – the tax return that you’ll file in 2021. And… postcard-sized, it’s not. Let’s dive right in.

Virtual currency. At first blush, the top of the return doesn’t look much different from the 2019 tax return with one rather interesting exception: the virtual currency question’s placement. A new cryptocurrency compliance measure for taxpayers was introduced in 2019 in the form of a checkbox on the top of Schedule 1, Additional Income and Adjustments to Income (downloads as a PDF). Schedule 1 is used to report income or adjustments to income that can’t be entered directly on the front page of form 1040.

I noted last year that the IRS has made no secret that it believes that taxpayers are not correctly reporting cryptocurrency transactions. An IRS dive into the data showed that for the 2013 through 2015 tax years, when IRS matched data collected from forms 8949, Sales and Other Dispositions of Capital Assets, which were filed electronically, they found that just 807 individuals reported a transaction using a property description likely related to bitcoin in 2013; in 2014, that number was only 893; and in 2015, the number fell to 802.

You may recall that I wasn’t a fan of the location since taxpayers who don’t have to file Schedule 1 for any other purpose may not be aware that they need to file Schedule 1 to answer to this question if it applies to them. Yes, tax software interviews will likely catch it – but what if they don’t? Or what if taxpayers are completing the form by hand? Or if tax preparers don’t think to ask? I said at the time that “I think it’s something that IRS will need to address.” Clearly, they did.

I also noted at the time that “It’s clear that the IRS is getting serious about cryptocurrency reporting.” I think the new placement of the virtual currency question signals – even more than before – that the IRS is taking action.

Standard Deductions and Dependents. Largely nothing to see here. The information requested and the layout remain mostly the same.

Charitable contributions. Typically, you don’t see reference to charitable contributions until Schedule A. However, due to the CARES Act, charitable cash contributions of up to $300 are temporarily above-the-line deductions. That means that you do not have to itemize to claim those deductions – something that many taxpayers have grappled with because of the increased standard deduction under the Tax Cuts and Jobs Act (TCJA).

Income items. Outside of the adjustments to income, there isn’t much difference in income reconciliation. We’ll just have to get used to yet another line number for taxable income (tentatively line 15).

Tax, Credits, and Deductions. Page two of your Form 1040 – where you figure your tax, withholding, and what you actually owe (or are due a refund) is where many changes are for 2020. One thing that jumps out immediately is that the trusty “Federal income tax withheld from Forms W-2 and 1099” line has been divided into separate lines for withholding for Forms W-2, 1099, and “other.” This suggests an increased level of scrutiny for the self-employed and gig workers (I could be wrong).

Stimulus Checks. We’ve been talking about it for a bit, but now we get to see how the stimulus checks will be reported. There is a separate reconciliation schedule that will carry over to page two of your Form 1040. The draft notes “see instructions” for specifics – but those instructions aren’t out just yet.

Refunds. Outside of some renumbering, the refund sections have not changed.

Amount You Owe. Usually, figuring the amount you owe is pretty simple: it’s tax due less credits and payments. But there’s a new line for 2020 which notes: Schedule H and Schedule SE filers, line 37 may not represent all of the taxes you owe for 2020. See Schedule 3, line 12e, and its instructions for details.

And yes, Schedule 3, line 12e, is new. It says: Deferral for certain Schedule H or SE filers (see instructions) That deferral? Under the CARES Act, employers may defer the deposit and payment of the employer’s portion of Social Security taxes. The deferral applies to deposits and payments of the employer’s share of Social Security tax that would otherwise be required to be made during the period beginning on March 27, 2020, and ending December 31, 2020, with half being due on December 31, 2021, and the remainder due on December 31, 2022. What does that have to do with Form 1040? The relief also applies to self-employed persons.

There are more changes to come since the IRS just released a slew of draft returns, but this gives you a sense of the direction things are heading (spoiler alert: more complicated, not less).

A cautionary note: This is a draft return, and not yet the real thing. That means, reminds the IRS, “Do not file draft forms and do not rely on draft forms, instructions, and publications for filing.” The IRS cautions that “unexpected issues occasionally arise, or legislation is passed” which means that this form could look a lot different in the final version that it does now. Things could change – and if we’ve learned anything from 2020, it’s that they probably will.